-

100+

Clients Served

-

5000+

Invoices Processed Per Month

-

200+

Completed Projects

-

15000+

Reconciliation in a Month

-

250+

Completed Projects

Gain Financial Clarity with Our Management Accounting Services

Take control of your finances with management accounting that does more than crunch numbers. We provide actionable insights to optimize cash flow, streamline budgets, and keep your financials organized. Let us handle the details, so you can focus on growing your business with confidence. Partner with us for clarity, precision, and smarter decisions every step of the way.

Outsourced Management Accounting Services We Offer

- Internal Audit

- Periodic Reports

- Financial Risk Management

- Cashflow Management

- Payroll

- Accurate Budgeting and Forecasting

- Cost Accounting

- Accounts Reconciliations

- Internal Audit

- Financial Strategy

- Project Management

Challenges We Tackle for You

With over 10 years of expertise, we simplify management accounting, tackling challenges like cash flow and budgeting for smarter, faster decisions.

Inconsistent Financial Reporting

Timely and accurate reporting is vital for making informed decisions, but inconsistencies can lead to confusion and missed opportunities. We ensure that all your financial reports are well organized, precise, and tailored to your specific needs. With our management reports, you’ll always have a clear picture of the financial health of your business.

Budgeting and Forecasting Roadblocks

Accurate budgeting and forecasting are crucial for planning growth and avoiding financial pitfalls. We tackle these challenges by preparing realistic, data-driven budgets and forecasts that align with your business goals. This ensures you are always prepared for what is ahead, whether it is growth opportunities or market fluctuations.

Complex Financial Data Analysis

Handling large volumes of financial data can be overwhelming. We simplify this complexity by breaking down raw data into clear, actionable insights. Whether it is understanding profitability, cost structures, or financial performance trends, we provide the information you need to make smarter decisions without confusion.

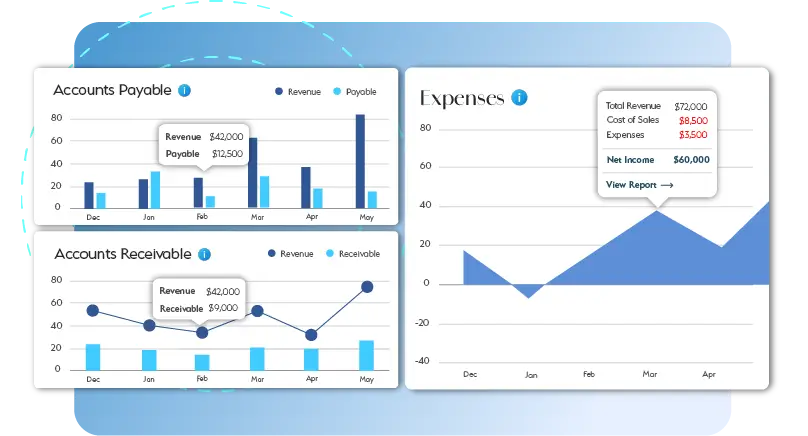

Turning Financial Data into Winning Strategies

Handling financial complexities becomes effortless with our management accounting expertise. From precise cash flow management to delivering actionable reports, we utilize advanced tools and strategies to streamline operations, reduce errors, and provide clear insights. Let us help you make confident decisions and keep your business ahead of the curve.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Management accounting focuses on analyzing and interpreting financial data to help businesses make informed decisions. It includes budgeting, forecasting, performance evaluation, and cost management to improve operational efficiency and strategic planning.

Management accounting is internally focused, providing insights and reports to aid decision-making within a company. Financial accounting, on the other hand, is external-focused, preparing financial statements for stakeholders like investors and regulatory bodies.

Outsourced management accounting services save time, reduce errors, and provide expert insights without the need for in-house staff. It ensures accurate financial analysis and allows businesses to focus on growth and strategic goals.

Reports typically include budget variance analysis, profitability analysis, cost-benefit analysis, cash flow forecasts, and key performance indicator (KPI) dashboards.

Yes, small businesses can greatly benefit from management accounting as it helps optimize limited resources, control costs, and plan for growth effectively.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Outsourced Management Accounting Services: Empowering Businesses for Growth

Effective financial management is at the heart of every successful business. Yet, managing complex financial tasks like budgeting, forecasting, and cost analysis can be daunting, especially for small to medium-sized enterprises. This is where management accounting services come in, offering a strategic approach to handling finances. By outsourcing these services, businesses can tap into expert knowledge while focusing on their core operations.

Get a CallOutsourced management accounting services involve delegating financial tasks to professional management accountants who specialize in budgeting, performance analysis, and cash flow management. These experts provide actionable insights, helping businesses make informed decisions and optimize their resources. For companies looking to improve efficiency and profitability, outsourcing is a cost-effective solution.

- Access to Expertise: Outsourced management accounting for business connects you with seasoned management accountants who have extensive experience across industries. These professionals provide in-depth financial analysis and strategic advice tailored to your business needs.

- Cost Efficiency: Building an in-house accounting team can be expensive. Outsourcing a management accounting service eliminates overhead costs like salaries, benefits, and training while delivering high-quality results.

- Data-Driven Decisions: Management accountants use advanced tools to generate precise reports and forecasts. This ensures businesses have accurate financial data to support strategic decisions, whether it’s planning for growth or managing risks.

- Enhanced Focus on Core Activities: With financial tasks in the hands of experts, business owners can dedicate more time to innovation, customer service, and other essential operations.

- Scalable Solutions: Outsourced management accounting services are flexible and can adapt to your business’s needs, whether you’re scaling up or navigating seasonal fluctuations.

Outsourced management accounting for business provides more than just number-crunching—it offers insights that drive success. From improving cash flow to streamlining budgets, management accountants play a pivotal role in shaping a company’s financial health.