-

100+

Clients Served

-

5000+

Invoices Processed Per Month

-

200+

Completed Projects

-

15000+

Reconciliation in a Month

-

250+

Completed Projects

Simplifying Financial Reporting for Your Business

We go beyond the numbers to provide clear, concise reports that bring your financial performance into focus. Whether it’s ensuring accuracy, maintaining compliance, or uncovering key insights, we handle it all so you can concentrate on growing your business. With Whiz Consulting, financial clarity is always within reach!

Financial Reporting Services We Offer

- General ledger reports

- Trial balance preparation

- Fixed asset and depreciation calculation

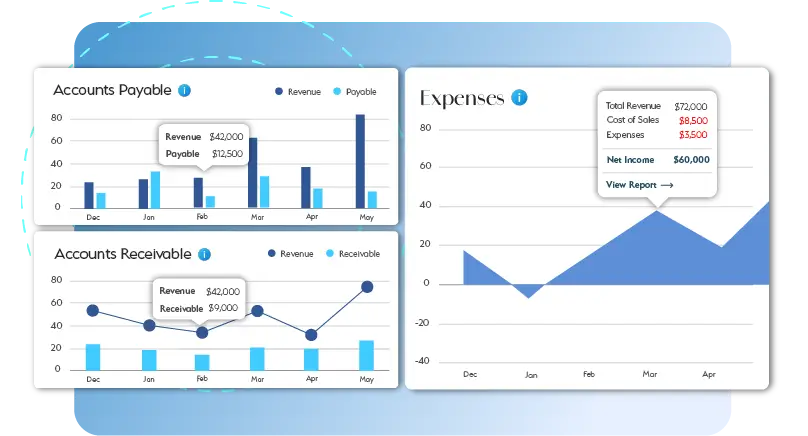

- Accounts payable reports

- Accounts receivables reports

- Financial Statement Analysis

- Bank reconciliation reports

- Inventory reports

Challenges We Tackle for You

We provide financial reporting services, fully addressing the major challenges that businesses face in managing their finances.

Organizing Financial Data

Financial records which are not well organized or kept consistently may complicate the decision-making process. We make sure that all of your data is reliable, consistent, and easy to read, and serve as a solid basis for strategic planning.

Converting Data into Actionable Insights

The raw financial data is overwhelming and difficult to interpret. We summarize your numbers into insights, so that you have the information needed to make data-driven business decisions with confidence.

Bringing Consistency in Accounting Practices

Establishing consistent accounting practices ensures reliable financial reporting. We set-up standardized procedures to maintain accuracy and long-term financial stability.

Your Financial Clarity, Our Priority

Whether it’s standardizing complex financial data or keeping pace with changing standards, our financial reporting services assist in achieving your business goals. We use modern tools and expert analysis to generate verified, relevant, and on-time reports. With our support, you’ll have deeper insights, mitigate errors, and make better decisions that move your business forward.

Behind on

your books?

Behind on

your books?

Take advantage of Catch-Up Bookkeeping, and you’ll never feel behind on your books again.

- Tailored Onboarding

- Seamless Integration

- Data Migration Support

- Dedicated Account Manager

- No Disruption to Operations

- Scalable Solutions

Switching to Whiz is Simple!

Making the shift to a new accounting partner might seem daunting, but with Whiz, it's a hassle-free experience. We guide you every step of the way, ensuring a smooth transition with no downtime or disruptions. Focus on what you do best while we take over the responsibilities of your books.

Switch Now

Our Technology Partners

Empowering innovation with cutting-edge solutions designed to drive efficiency and transformation.

Why Choose Us?

-

Innovative Workflow

We leverage cutting-edge technology and best practices to create streamlined workflows that ensure accuracy, efficiency, and timely delivery of your financial reports.

-

Seamless Collaboration

Our team works closely with you/team to ensure smooth communication and a deep understanding of your bookkeeping needs. Whether it's a quick update or a strategic discussion, we're always just a call away.

-

Decade of Experience

With over 10 years of industry experience, we have a proven track record of helping businesses from various sectors stay organized and financially sound.

-

Dedicated Experts

Our team consists of highly skilled, certified professionals who are dedicated to supporting your business. From accountants to financial analysts, we have the expertise to handle your unique challenges.

-

Real-Time Insights

Gain a clear, up-to-date view of your financial health round-the-clock. Our real-time reporting and dashboards provide actionable insights that help you make informed decisions and drive business growth.

-

Cost Savings

Outsourcing your accounting and bookkeeping with us means lower overhead costs. We offer scalable services tailored to your needs, helping you save on hiring, training, and maintaining an in-house team.

Client Testimonials

See how we've helped others achieve their financial goals with personalized solutions and expert guidance.

How It Works

We simplify the process to help you achieve your financial goals with ease.

-

Seamless Transition

We ensure a smooth, hassle-free transition, minimizing disruption to your operations.

-

Transparent Communication

We keep you informed at every step with clear, open communication.

-

Accurate Finances

Our team provides precise financial tracking to ensure everything stays on budget and within scope.

Have questions in mind? Find answers here...

Yes, your data will remain secure. We implement advanced encryption protocols, follow strict confidentiality agreements, and adhere to industry standards to ensure your information is fully protected.

Absolutely! Outsourcing is ideal for small businesses. It offers cost-effective access to expert professionals, streamlines reporting, and helps you focus on growing your core operations.

We tailor timelines to meet your needs. Standard reports are typically delivered within agreed deadlines, ensuring accuracy without delays. Custom requests may require additional time.

Yes, you maintain full control. We provide transparent processes and regular updates, allowing you to review and approve reports while we handle the detailed tasks.

Outsourcing saves time, reduces costs, and ensures accuracy. It grants access to experienced professionals and advanced tools, improving decision-making and compliance without increasing overhead.

Thousands of business owners trust Whiz to manage their account

Let us take care of your books and make this financial year a good one.

Outsourced Financial Reporting Services: Simplifying Your Financial Management

Managing financial reporting in-house can be a resource-intensive challenge for businesses. It requires a keen focus on accuracy, compliance, and data interpretation-all while staying on top of dynamic market and regulatory demands. By outsourcing financial reporting services to experts, you can ensure your financial data is not only accurate but also strategically insightful. Curious to know more? Let’s explore how outsourced financial reporting services can elevate your business operations:

Get a CallFinancial reporting involves consolidating vast amounts of data, often requiring advanced technical expertise. The cost of hiring in-house professionals with the necessary skills, along with investing in infrastructure, can be significant. Instead, outsourcing financial reporting services ensures access to a team of specialists who can deliver timely, precise, and customized financial reports, saving you both time and money.

Outsourced financial reporting firms rely on cutting-edge tools and technologies to enhance accuracy and efficiency. From automated reconciliation to cloud-based dashboards, these tools provide comprehensive insights into your company’s financial health. Additionally, cloud platforms allow you to access real-time financial data securely from anywhere, ensuring transparency and control.

Navigating complex regulations and financial standards can be daunting. Outsourcing financial reporting services ensures your reports align with the latest accounting standards and legal requirements. Expert professionals monitor regulatory updates to keep your financial records compliant, reducing the risk of penalties and enhancing audit readiness.

Transforming raw financial data into actionable insights is a cornerstone of effective financial management. Outsourced financial reporting services provide detailed analysis and visualized data to help you understand trends, identify opportunities, and address challenges. These insights empower you to make data-driven decisions with confidence.

As your business evolves, so do its financial reporting needs. Outsourced services offer the flexibility to scale up or down based on your operational demands. Whether you’re experiencing growth or seasonal fluctuations, you only pay for the services you need, making this an efficient solution for businesses of all sizes.

Accurate and timely financial reports are vital for effective cash flow management. Outsourced financial reporting ensures regular updates and clear visualizations of your financial position, aiding in better budgeting, forecasting, and investment planning. This clarity helps you avoid cash flow bottlenecks and maintain business continuity.

By entrusting financial reporting to experts, your internal team can focus on core business activities. Outsourcing eliminates the burden of handling intricate reporting tasks, allowing you to channel your resources toward innovation, growth, and customer satisfaction.

The financial landscape is ever-evolving, with new standards and practices emerging regularly. Outsourced providers stay updated with industry changes, ensuring your financial reports meet modern benchmarks. This proactive approach ensures long-term accuracy and reliability.

Outsourcing financial reporting services is a strategic decision that enables businesses to streamline operations, reduce risks, and drive growth. By partnering with the right service provider, you can build a robust foundation for financial management while focusing on your organization’s core objectives. Make the switch to expert-driven financial reporting and experience the difference in your business outcomes.